5 Avenues to invest your money effectively

When you come from a financially weak background you understand the real value of money and work toward saving and accumulating as much of it as you can. One way to do it is by keeping the money idle in saving account where there is a minimum or no interest. Another way to accumulate wealth is by strategically diversifying your savings into investments that generate returns on its own.

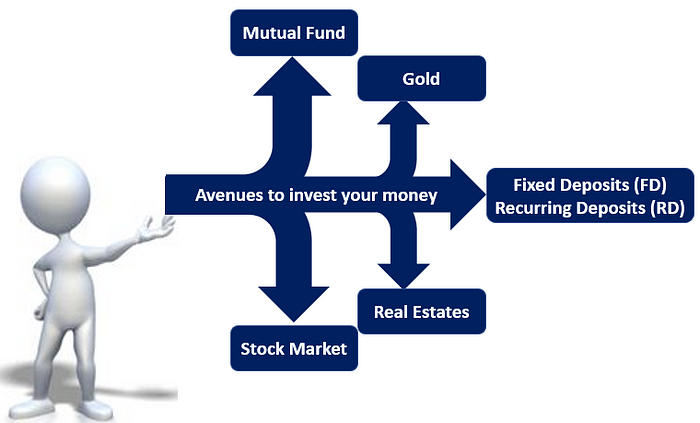

In this post, I will explain the 5 main avenues that you can use to invest your money more effectively. Each of the investment categories is associated with its own risk factor. You can first analyze your risk appetite from low-moderate-high and then choose the right investment category.

Source: https://shyamsewag.blogspot.com/2020/08/5-avenues-to-invest-your-money.html

To manage the risk, you can also look at investing in multiple categories which will provide a risk cushion. Let me now explain more about these investing categories in detail:

1. Fixed / Recurring Deposits

Fixed Deposits (FD) and recurring deposits (RD) are one of the safest categories to invest your money. These are mostly offered by financial institutions like banks, co-operative societies, NBFCs (Non-Banking Financial Corporations), etc.

FD is an investment category where you can invest a lump sum amount for a specific period. This can be as short as 7 days and as long as 10 years. You have the choice to select the investment period. On maturity, the principal amount gets added with the interest earned for the period and you get the final amount. Some banks also offer a facility to reinvest the amount at maturity which can be beneficial if the amount will not be utilized immediately.

Recurring Deposits (RD) is another popular category offered by financial institutions where individuals can deposit a specific amount at a specific interval (monthly or quarterly). This also has a predetermined rate of returns which gets included in the principal amount and the accumulated amount is given at the time of maturity.

Rate of Returns

The rate of returns on these categories is fixed and comparatively lower than some of the other investment categories. The rate of returns is determined initially by the Central Bank of the country where the individual financial institutions can offer a higher rate than the base rate provided they can fulfill their commitments. You get a clear picture of how much money you will receive at the end of the maturity period.

Risk Factor

Every investment is associated with its own risk factor from minimum to moderate to high. For FD and RD the risk factor is minimum because the returns are fixed and usually the schemes are offered by financial institutions that are governed by the central body of administration. This is the main reason why elderly people are keener on investing in FD and RD.

If you want to have a safe and secured investment then you can also invest in FD and RD.

2. Mutual Funds

The concept of a mutual fund is simple and easier to understand. But, the different types and expenses associated with them complicate the things. It will take a separate blog post to explain in detail the types and expenses. Mutual funds serve as a medium for purchasing or owning stocks in the market. When you invest your money you are allocated a unit/portion of the total assets which can be sold to redeem your investment. The fund that is raised by accumulating money from individuals gets further utilized to purchase stocks or invest in financial instruments. The returns generated from the investment get distributed to the individuals who had invested the money and that is how your investment grows.

In Mutual funds, you have 2 options, one to invest a lump sum amount at once and second to start a systematic investment plan (popularly termed as SIP). There are many parties between the investor and his/her investment. These parties include the Asset Management Company (AMU), NSDL/CDSL (centralized governing body), fund manager, etc. There are multiple types of mutual funds tax saving, debt, equity, theme-based, sector-based, etc.

After this, choosing a mutual fund from the vast available options becomes confusing and as a result, many people drop the idea of investing in mutual funds. But, on the contrary, if you have a vision and clarity of one particular goal then you can narrow down the search to the top mutual funds.

Rate of Returns

The rate of returns in case of mutual funds is depended upon the type, investment strategy adopted by the fund manager, period of investment, etc. hence quoting a specific number will be misleading.

Risk Factor

The risk associated with the mutual fund can fall in all the three categories (minimum to moderate to high) depending upon the type of mutual fund you have invested your money in. As the disclaimer for almost all the schemes mentioned, investments are subject to market risks therefore read all the scheme related documents carefully.

3. Stock Markets

Stock markets have their own share of terrifying experiences for some people. Investing in stocks has been considered a job for people with excellent knowledge and years of experience in the stock market. With the rise of digital age and information at your fingertips this has been simplified to such a level that anybody can start investing in the stock market.

Stock markets are governed by the centralized administrative body and have transactions related to buying and selling of shares as well as commodities. Stockbrokers are known for extracting their commissions from every transaction and flourishing on their clients’ investment but that is not the complete picture. In today’s world, you can start investing directly without taking help from any stockbroker. As a result of this, we do not have to worry about commissions and save even more money.

The charges that you need to pay for investing in the stock market include annual maintenance fees payable to your service providers, securities transaction tax (STT), brokerage charges, etc. While investing in the stock market you need to keep these expenses in mind to book your profits.

I will cover the process of starting your journey in the stock market and what you should do to minimize your losses and develop your investment strategy.

Rate of Returns

The rate of returns for the investment in the stock market depends upon how the market is performing vs. at what price you bought the stocks. The general philosophy or logic dictates that you are supposed to buy the stocks at a low price and sell them at a high price but in the real dynamic world it is difficult to determine the perfect low and perfect high price. To achieve the maximum returns, you are required to have patience and decisive ability to book the profits. The factor of greed comes in the uptrend where a stock rises and rises to a point from which it shows a significant drop. If you can take a decisive call to sell the stock and book profit then you can get away from disappointments.

It has been observed that the stock markets reward your investment with time hence the duration of your investment also matters to determine the rate of returns. The longer you stay invested the higher chances you have to get a better rate of return and subsequently accumulate wealth.

Risk Factor

From past experiences, it can be concluded that the risk factor in the stock market is on the higher side. Even the veterans face tremendous losses due to the uncertainties in the global markets as the stock markets go through a ripple effect. Adverse situations in one country can highly affect the others. For example, the global crisis in 2008 started from the US and captured the world economy creating a period of agony for traders and investors across the globe.

Therefore, it is always recommended to have a basic knowledge of how the stock market functions and to develop your own strategy to trade or invest in the stock market.

4. Gold

Gold is treated as a global currency. We have moved from the barter system to the paper money system and now we are in the age of digital payments. But, gold as an instrument for investment is something that has its value from a traditional and financial point of view.

In Indian culture, gold has a significant value in the form of ornaments as well as investment. People who buy gold for investment keep it for the worst phases of life as it can be sold easily or they can borrow financial aid in the form of loans by keeping its mortgage. From a country’s point of view, the new monetary system allows countries to print the amount of physical money by keeping certain gold reserves. So overall, gold serves as one of the safest forms of investment.

Investing in gold has its own benefits, first of all, it is easy to carry and easy to store. Secondly, it can be kept idle or can be molded into ornaments. The liquidity power is tremendous as it can be sold at jewelry shops as well as kept as a mortgage in financial institutions.

The governments have also offered schemes to promote investment in gold through sovereign gold bonds in which you do not hold the physical possession of the metal but have a specified rate of returns at a specific maturity period.

Considering all this, gold has more financial and retail value compared to other precious metals. Hence if you have a conservative approach and huge idle money at your disposal then you can invest that in gold.

Also read: Gold: the most effective commodity investment

Rate of Returns

To understand the rate of returns we have to take a look at the historical gold prices and we can understand that majorly the prices of gold have shown an uptrend resulting in appreciation for your initial investment.

Data source: Bankbazar.com

As you can observe from the above graph, majorly, there has been an uptrend in the prices of gold. The price of gold fluctuates on a daily basis hence the average price for each year has been taken into consideration for the purpose of data preparation.

Risk Factor

The risk factor is mainly related to its physical security. Gold can be stolen and sold in black markets. Another risk associated with an investment in gold is more towards the sudden rise and fall in the prices of gold. We have seen in the past many occasions in which due to various reasons the gold prices have come down as opposed to the general uptrend. Otherwise, the risk factors are very few hence it is an ideal option for investors with a conservative approach.

5. Real Estate

Investment in real estate is something that is categorized into capital investment and you require a huge inflow of money. The real estates have a unique factor that generally they are not depreciated which provides you a cushion against adversities.

Few things that you need to keep in mind while investing in real estate are more related to documentations and abiding by government rules and regulations. There are multiple legal formalities involved while buying a real estate. This is applicable in both cases residing as well as just buying a property as an investment.

Identifying a suitable property, getting all the paperwork in place, paying all the taxes and duties to finally take the ownership and possession of the property is a time-consuming endeavor, therefore, you need to be completely prepared for all the hustle that goes into buying a property. Even after buying the property, you need to incur a huge amount of expenses like municipal taxes, construction, or renovation expenses, if you have used it for rent generation then paying taxes on that income making it even difficult to keep with you.

Moreover, as it is an immovable asset you need to rely upon the official valuation of the property in case you are planning to sell the same and wait till you come across the right buyer making it even more difficult to convert to cash.

Photo by Morning Brew on Unsplash

Rate of Returns

Unlike other investment categories, the rate of returns for real estate cannot be specified. The returns that get generated depend upon locality, official valuation, and especially the demand in the market. Generally, the value of real estate appreciates in value but the rate of appreciation is uncertain. Therefore, you need to be extremely cautious while purchasing a property if you are planning to resell it and book profit.

Risk Factor

The risk factor associated with an investment in real estate is the majority due to changes in government regulations. If the government imposes any cap or limit on the land that you can have then you might need to lose some. Other risks are associated with natural calamities like earthquakes, landslides, and so on. As it is an immovable asset you can not store it at a safe place. Therefore, you have to put more effort into researching the property before buying the same.

I hope the information was useful and I was able to convey a general idea about the different avenues of investing your money effectively. Let me know your thoughts and suggestions in the comment section.

visit my blog for more posts like this: https://shyamsewag.blogspot.com/